My Nokia Blog |

- Lumia 920 for $19.99 and 820 for $0.01 on Amazon Wireless

- AAS: Camera Shootout Time!: N8 vs Xperia Z and 808 vs Xperia Z vs 920!

- MNB Reader Generated: OS Wide Magnification in WP8 #TIP

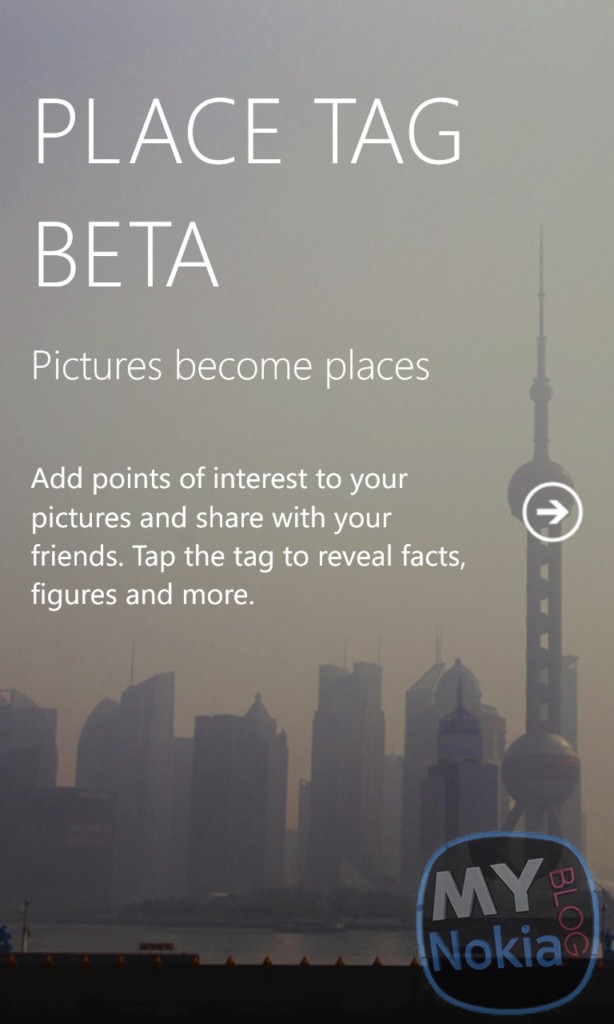

- Place Tag Beta, GeoTagging Postcard App; Now Available to Download

- Nokia Annual Financial Report 2012

- Nokia reveal’s Stephen Elop’s 2012 Salary. Base salary up but no bonuses, effectively half of 2011 salary

| Lumia 920 for $19.99 and 820 for $0.01 on Amazon Wireless Posted: 08 Mar 2013 09:38 AM PST

It’s been a while since we’ve seen any activity on the Lumia 920 and 820′s pricing, but I noticed that both the Lumia 920 & 820 have been discounted. The 920 is available for $19.99 and the 820 for just a penny (I don’t recall it being available on Amazon before). So if you’re still holding out on getting a WP8 lumia you could do a lot more worse than right now (unless you’re holding out for a 520 or 720). Lumia 920:

Lumia 820:

| |||||||||||

| AAS: Camera Shootout Time!: N8 vs Xperia Z and 808 vs Xperia Z vs 920! Posted: 08 Mar 2013 06:29 AM PST

Hello MNB Readers! Our friend, Steve Litchfield, over at All About Symbian has a duo of camera shootout articles that are worthy of a read and extended look. While celebrating N8 Day, Steve pulled out the former World Champion camera title belt holder (N8) and put it in a shootout against what is considered the cream of the crop Android camera phone, the Sony Xperia Z. Steve wrote:

Head over to AAS for more on this story: AAS Also, you can’t keep a camera expert and Nokia fan idle for too long because Steve has a followup article pitting the Nokia 808 PureView against the Sony Xperia Z and the Nokia Lumia 920! From the opening of the article:

Read on indeed: AAS I like AAS’s camera comparison articles as they are straight to the point and honest. As a N8 user, it is great to see that the N8′s larger sensor, xenon flash and optics have kept the camera above average for going on 3 years. As a future 808 owner, I can’t wait to get my hands on one and start a new generation of quality photos for years to come. It is also good to see that cameras on mobile phones are improving across the board and that my friends, is good news for all camera buffs, no matter the brand or OS affiliation. What say you, our dear MNB readers? Have you made any camera comparisons or noticed great leaps in quality with your own devices? Perhaps you own a non Nokia that has a great camera that beats out other phones as a 3rd runner-up (N8 2nd, 808 1st). Sound off in the comments section below.

Thanks to Steve and the AAS Team for their continued coverage of the photography side of the smartphone spectrum.

Image credit: Steve Litchfield, Copyright (©) All About Symbian 2000-2012 | |||||||||||

| MNB Reader Generated: OS Wide Magnification in WP8 #TIP Posted: 08 Mar 2013 12:49 AM PST One of our readers “Nabkawe” sent us a cool tip about the OS wide magnification available in WP8; basically it allows you to enlarge ANY part of the OS with no restrictions, read on below to find out more: If you’re new to WP8 you might use your software like an idiot for a while ignoring cool small things that saves you lots of headaches. Like if a notification popped up you might wait for it to go away to continue your game while not knowing you could swipe it to the right and be done with it, or when you’re using the keyboard and don’t know that if you held the &123 key and went to the number/symbol you wanted you can skip the layout change. or that you can actually call the person you’re texting by clicking his name on top. or switch to Facebook messaging by clicking the arrows bellow. you might not know that you can screenshot any video even when paused to get pictures out of them. Eventually you’ll learn it , but here’s top notch small feature you didn’t know it was there (or perhaps what to do with it. ) The most amazing feature in WP8 (and exclusive I might add) that no one seems to use often (although very important) By now you are saying its just zoom relax … Another use case would be Close ups photography , you know that feeling when you want to zoom so you can frame or insure the focus of your shot but you still don’t want to actually zoom and ruin the picture , this is the solution for you my flower shooting loving friends. another cool usage case is photo editing , in apps like Nokia exclusives (Burton/Cinemagraph) or professional photo editing tools (Fantasia Painter) , you might want a more accurate brush strokes and zooming again saves the day. I think there are as many use cases for this as one could be creative to think of so don’t ignore it , show it off to your friends and enjoy your WP8 phones. | |||||||||||

| Place Tag Beta, GeoTagging Postcard App; Now Available to Download Posted: 08 Mar 2013 12:39 AM PST

http://www.windowsphone.com/en-us/store/app/place-tag-beta/547610c8-e367-49db-8a6d-d279489b753a | |||||||||||

| Nokia Annual Financial Report 2012 Posted: 07 Mar 2013 11:06 PM PST

Yesterday, Nokia released their 2012 Financial Report. Head over to 20-F in the financial filings page. It’s a long read but quite enlightening document if you have the time (such as Nokia’s forseen risk factors and future plans)

Some of the topics of discussion: | |||||||||||

| Posted: 07 Mar 2013 11:05 PM PST

In Nokia’s financial report yesterday, Nokia revealed CEO Stephen Elop’s salary. Whilst the base salary increased 60k Euros to 1.08M Euros, he did not earn a bonus for 2012. Compared to 2011, Elop has received a compensation ‘pay-cut’ from 7.94M Euros to 4.33M Euros. Not sure if this included any one time payments. From the 20-F Nokia document: Stephen Elop's service contract covers his position as President and CEO as from September 21, 2010. As at December 31, 2012, Mr. Elop's annual base salary, which is subject to an annual review by the Board of Directors and confirmation by the independent members of the Board, is EUR 1 102 500. His incentive target under the Nokia short-term cash incentive plan is 100% of annual base salary as at December 31, 2012. In addition, Mr. Elop had a separate plan for 2011-2012, approved by the Board of Directors. Description and outcome of this plan is below. Mr. Elop is entitled to the customary benefits in line with our policies applicable to the top management, however, some of them are being provided on a tax-assisted basis. Mr. Elop is also eligible to participate in Nokia's long-term equity-based compensation programs according to Nokia policies and guidelines and as determined by the Board of Directors. In case of termination by Nokia for reasons other than cause, Mr. Elop is entitled to a severance payment of up to 18 months of compensation (both annual base salary and target incentive) and his equity will be forfeited as determined in the applicable equity plan rules, with the exception of the equity out of the Nokia Equity Program 2010, which will vest in an accelerated manner (the performance period of Nokia Performance Share Plan 2010 ended in 2012 and no shares were delivered in accordance with its terms). In case of termination by Mr. Elop, the notice period is six months and he is entitled to a payment for such notice period (both annual base salary and target incentive for six months) and all his equity will be forfeited. In the event of a change of control of Nokia, Mr. Elop may terminate his employment upon a material reduction of his duties and responsibilities, upon which he will be entitled to a compensation of 18 months (both annual base salary and target incentive), and his unvested equity will vest in an accelerated manner. In case of termination by Nokia for cause, Mr. Elop is entitled to no additional compensation and all his equity will be forfeited. In case of termination by Mr. Elop for cause, he is entitled to a severance payment equivalent to 18 months of notice (both annual base salary and target incentive), and his unvested equity will vest in an accelerated manner. Mr. Elop is subject to a 12-month non-competition obligation after termination of the contract. Unless the contract is terminated by Nokia for cause, Mr. Elop may be entitled to compensation during the non-competition period or a part of it. Such compensation amounts to the annual base salary and target incentive for the respective period during which no severance payment is paid. The Board of Directors decided in March 2011 that in order to align Mr. Elop's compensation to increased shareholder value and to link a meaningful portion of his compensation directly to the performance of Nokia's share price over the period of 2011-2012, his compensation structure for 2011 and 2012 would be modified. To participate in this program, Mr. Elop invested a portion of his short-term cash incentive opportunity and a portion of the value of his expected annual equity grants into the program as follows:

In consideration, Mr. Elop had the opportunity to earn a number of Nokia shares at the end of 2012 based on two independent criteria, with half of the opportunity tied to each criterion:

|

| You are subscribed to email updates from My Nokia Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment